Contact us at the Consulting Synergy Evolution nearest to you or submit a business inquiry below.

Introduction To Asset Management

Do You Wonder, “What is Asset Management?”, “Is Asset Management for Me?”, or “What is an Asset Manager?”

For a long while, asset management has been an indigenous practice in African societies. It might not have been as structured as it is today, but it did present a level of sophistication for its time.

This was a practice that included our grandfathers keeping meticulous records of livestock, best practice breeding, appropriate feeding, upkeep, etc. In some instances, they would give the cattle names that were easy to remember.

This is just one example of an asset (cattle) they managed. Not only that, assets expanded to land, property (Fixed or Movable), crops, jewelry, pottery, animal skins, tools, and a whole lot of other things that had value.

Thus in reality asset management isn’t a new concept.

That being said, in today’s world asset management is a critical component in wealth creation and even wealth transfer.

Asset management is an important process in any company, company size, or industry.

Suppose you’re thinking of getting into asset management. Or want to learn more about the process. If or want tips on types of asset management and how asset management benefits you, then this article is for you.

Learn more about managing your assets by reading this article now!

Start by reading the rest of this article now on asset management!

What is Asset management?

Definition – Asset management is the process of managing an individual or company’s physical and financial assets.

Definition – Asset managers are responsible for the preservation, maintenance, and increase in value of assets.

Learn more about asset management, what it is, and how it can help your company today!

—

You are reading this because you are interested in asset management.

In this article, we detail information on asset management, types of asset management, benefits of asset management, and the process of asset management.

It also includes information on what an asset manager does.

Asset Management PDF

What do asset managers do?

Let’s start with what asset managers are. Asset managers are people who help companies optimize a portfolio. This includes maximizing the returns and minimizing the risks. This is done while investing in the best possible assets given their objectives and budget.

—

As a result, asset management is the monitoring, managing, and administering of the assets of a business or individual. An asset manager is a person in charge of making sure your company’s assets are used efficiently, and to their potential, generating maximum financial benefits.

Asset management is a crucial aspect of any organization’s success. It can often be a difficult thing to do well because it is not just about maximizing your investments. It’s about ensuring that you have the right balance between keeping things safe versus making them perform better.

That is where we come in as Synergy. Expertise in this exercise. With vast experience working with a wide variety of clients, you can be assured that your assets are in the best hands.

Resources are limited and it can be difficult to know which tasks need your attention. But with Asset management software, we’re able to stay on top of all your assets, both tangible and intangible.

Asset management is an umbrella term used to describe the oversight and coordinated management of an enterprise’s assets.

What is an asset?

As already mentioned earlier, assets of the immediate past included movable assets, property, cattle, tools, jewellery, land etc.

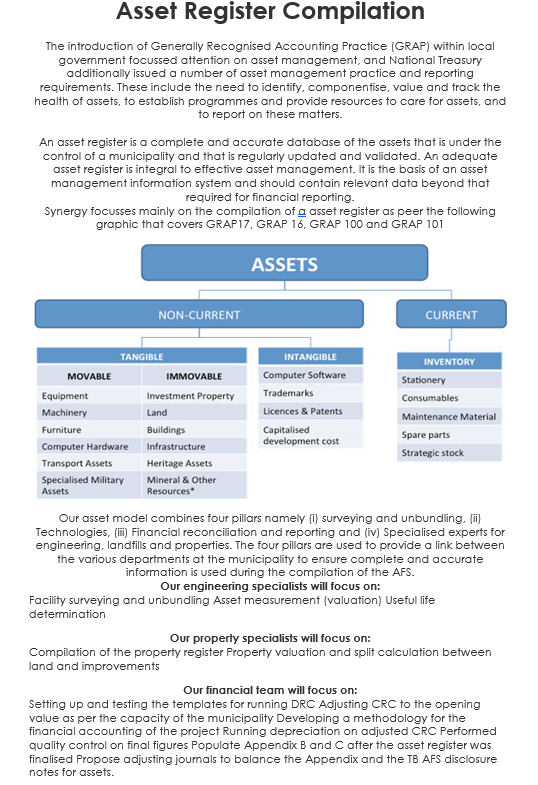

An asset can be either tangible or intangible. It can be anything that has value to your company, such as a machine, inventory, buildings, intellectual property, and data.

Let’s look at the types of asset management.

Types of asset management

There are four main types of asset management:

1. Fixed Asset Management.

This is an accounting process that seeks to track fixed assets for the purposes of financial accounting, preventive maintenance, and theft deterrence for the company.

Organizations face a significant challenge to track the location, quantity, condition, maintenance and depreciation status of their fixed assets. A popular approach to tracking fixed assets uses serial numbers and asset tags, which are labels often with barcodes for an easy and accurate reading.

The owner of the assets can take inventory with a mobile barcode reader and then produce a report. Off-the-shelf software packages for fixed asset management are marketed to businesses small and large.

Some enterprise resource planning systems are available with fixed assets modules. Some tracking methods automate the process, such as using fixed scanners to read bar codes on railway freight cars or attaching a radio-frequency identification (RFID) tag to an asset.

Fixed asset management enables organizations to monitor equipment and vehicles, assess their condition, and keep them in good working order.

In this way, they minimize lost inventory, equipment failures and downtime — and improve an asset’s lifetime value.

2. Financial management.

How to best use available assets (cash, equity, deposits) to generate more money (earnings) for the company.

As the name implies this type of asset management deals with finance-related assets. Some examples have been given above.

Asset managers like ourselves have the skill and the expertise to help you grow this asset and ensure that this resource is utilized to the best of its ability to grow the company.

These could be using cash reserves and deposits to purchase new stock, machines, or even more equity.

Human resource management.

3. How best to use and cultivate employees for maximum productivity and profitability (marketing) for the business.

Trust us when we say people can really be an excellent asset for a company. We can think of a number of companies today that are doing very well, because of how valuable their employees are.

And, just like any other asset, we are the preferred brand in managing this asset. Our proven record testifies to the strategies we use to motivate the employees and equip them with the right skills and knowledge work.

Using our strategies, your company employees are the unicorn to propel your company into super profitability.

4. Information technology asset management.

What information technology resources will best suit the company’s needs and generate maximal profit.

What information or proprietary information, system, processing etc. makes you unique and stand out amongst the rest. What other new emerging trends in information technology could be a game-changer for you? See this is why you need our services… a company that understands the need to manage IT in a way that’s profitable to you.

Visit our website to learn more about other related topics to asset management

10 Main Benefits of asset management?

- Accurate asset register – do you know which assets you have, where they are, their condition and value?

- Asset performance – do you know how your assets are performing and what their ideal performance should be?

- Asset related costs – is the cost of maintaining your assets optimal or should you spend less (or more) on them?

- Capital investment – do you have the capacity to deal with future demand? Are you making good decisions when investing in new assets?

- Optimal maintenance – are you doing the right maintenance on your assets to prevent breakdowns? Is it cost-effective?

- Risk management – are all your asset-related risks under control? Have they been identified, analyzed and treated as far as possible?

- Safety – is your plant safe for the people who work there? Could you be faced with the consequences of an accident or health problem?

- Competent people – are your people competent to operate and maintain the assets effectively? Or should you be outsourcing some activities?

- Spare parts and maintenance – are you keeping the right spare parts and material in stock? Are you keeping optimal amounts of these spare parts?

- Technical information – is your asset information (drawings, specifications and procedures) accurate and up to date?

Solutions Synergy Evolution offers to your business.

Here’s an overview of solutions that you can choose from. Click on the highlighted link to get more information.

Asset management solutions

- Asset, employees, leases, space and other verifications

- Data collection, cleansing and analytics

- Any type of research work

- Asset reconciliations

Business development, consulting and advisory services solutions

- Customer service

- project management

- CRM

- Business solutions

- Business process

- Management systems

- Information technology

- Cloud

- HR

- Business Partners

Education and training solutions.

Project management solutions

System and technology solutions

- System implementation

Why Choose Synergy?

Synergy Evolution is a game-changer for our clients. It’s not just an asset management firm. We are your partners in success. Here are 9 reasons why you and Synergy would work together well.

- Experience – ours ranges from the private sector, government, and municipal asset management projects.

- Knowledge – this reason has made our stay one above every other player in the market. We are knowledgeable of the private sector, government accounting standards and requirements.

- Expertise – we are experts in systems capable of supporting the accounting requirements.

- Track record – our clients testify of our work. We have worked with both local, national and international asset management projects.

- Access – this reason is key. Synergy has access to enhanced business skills (both policy and procedure development.)

- Commitment – Our clients require absolute commitment to see their assets well taken care of. We are committed to empowerment, skills transfer and local economic development.

- Ability to assist with physical asset verification, reconciliation, fair market valuations and related tasks.

- Capability to implement – Synergy is not just about talking. We are doers. We have the means to deliver a world-class management solution.

- Technology – Our tech is easier and user friendly to be used to perform physical asset verification.

Try us today, and see your asset growing in value and appreciation.

Asset Management Questions Answered

Who is the biggest asset manager in South Africa?

According to News24, the biggest asset management firm in South Africa is Ninety One. Ninety One unseated the Old Mutual Investment Group (OMIG) as South Africa’s largest asset manager.

The asset manager, which de-merged from Investec and listed separately in 2020, had £140 billion (R~2.6 trillion) at the end of its half-year period on 30 September 2021. And according to Alex Forbes’ annual retirement fund survey, Ninety One ended 2021 with R690.6 billion of assets managed on behalf of South African clients

How many asset managers are there in South Africa?

There are a number of asset managers in South Africa. There the established names like Ninety One, Stanlib, Coronation, Old Mutual etc.

New entrants like Synergy Evolution are revolutionizing the asset management industries. They are innovative, agile and are serving a wider network of clients. Synergy has the flexibility to offer services that ensure that you get the best asset management services in South Africa.

What do asset managers do?

Asset managers are responsible for the maximization of value and minimization of risks for a company’s asset. They monitor, evaluate and invest in assets. Their ultimate goal is to ensure that assets are efficiently managed and provide maximum value to the clients.

How much does an asset manager cost?

There are no fixed costs for asset managers. The costs associated with asset management varies depending on –

- Type of asset management services offered

- Company’s profile

- Extent of service

- And Size of assets among others.

As such it is difficult to ascertain how much an asset management costs.

Get in touch with us here, to get a quote and estimate how much the services might cost to you.

How do asset managers make money?

Asset managers in South Africa make money through service charges. They charge fees based on the type of services they offer, the size of the assets, and other consultation services they offer to clients.

Typically, the money they charge is a percent of the entire assets they manage. In some cases, they may charge based on the performance of the asset and they get bonuses if they outperformed their target.